Taxes off paycheck

Now lets explore the various business expenses you might qualify to write off from your taxes next. Youll input this number into your Schedule C to report Gross Earnings on Line 1.

Understanding Your Paycheck

Also on the Schedule C youll mark what expenses you want to claim as deductions.

. Canadian Payroll Calculator - the easiest way to calculate your payroll taxes and estimate your after-tax salary. However you can take pride in knowing youre making an important impact each week when you contribute to Social Security. March 23 2017 By Beth Kobliner Personal Finance Journalist New.

The first step to resolve an incorrect payroll tax calculation is to make sure you have the latest payroll update. As a rule of thumb you should double check review and possibly update your W-4 whenever the follow happens. Everytime you start off at new job you should at least receive a W-4.

It can also be used to help fill steps 3 and 4 of a W-4 form. Expires January 31 2021. Not valid on subsequent payments.

H and R. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. These are contributions that you make before any taxes are withheld from your paycheck.

From fashion editorials to tax advice. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states. Heres a list of items that appear on all paycheck stubs that you need to be familiar with.

The program also provides benefits to workers who take time off due to life events eg pregnancy. Business Travel Expenses Deduction. Make sure you send both the taxes you withheld from the employees paycheck and the taxes you owe as the employer.

However even in these situations other taxes may be due such as employer FICA taxes. Salary Paycheck and Payroll Calculator. See our article on how to update your QuickBooks payroll software.

This calculator is intended for use by US. If viewing in Workday use the scroll bars on the side and at the bottom of the section to scroll through the list if you have a large number of earning types for the pay periodIf viewing in PDF or on paper this section may be. You pay self-employment tax based on 9235 of your.

Discount is off course materials in states where applicable. For contributions made into your account you can claim a tax deduction of up to 2700 every year. If all taxes are calculated at 000 that may indicate an incorrect calculation.

Knowing where you stand now with Social Security will pay off. Discount must be used on initial purchase only. From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income.

Usage of the Payroll Calculator. If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block. For a weekly paycheck of under 21750 this means no wages could be garnished.

Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No Surprise Guarantee Upfront. Brands is a unique payroll service and HR firm that specializes in providing businesses like yours a low-cost and headache-free payroll and HR solution. On his days off you can find him at a basketball court or gym working up a sweat.

Net Pay This is the amount youre paid after all applicable taxes and deductions are taken out from your gross pay. No worrieshere well lay out all the state and federal taxes and paycheck rules so you can process your Florida payroll quickly and enjoy the ocean breeze. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

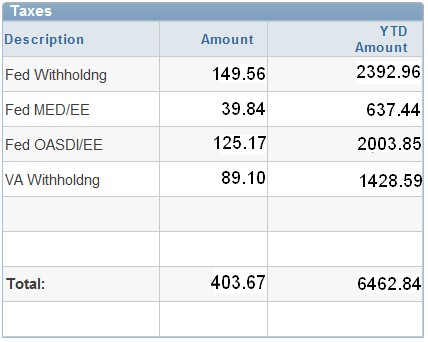

Learn more about the different taxes on your paycheck including federal state social security and medicare withholding with the experts at HR Block. Youd still get the big paycheck and youd be earning. Instead of withholding FICA taxes from each paycheck business owners and independent contractors make quarterly self-employment tax payments.

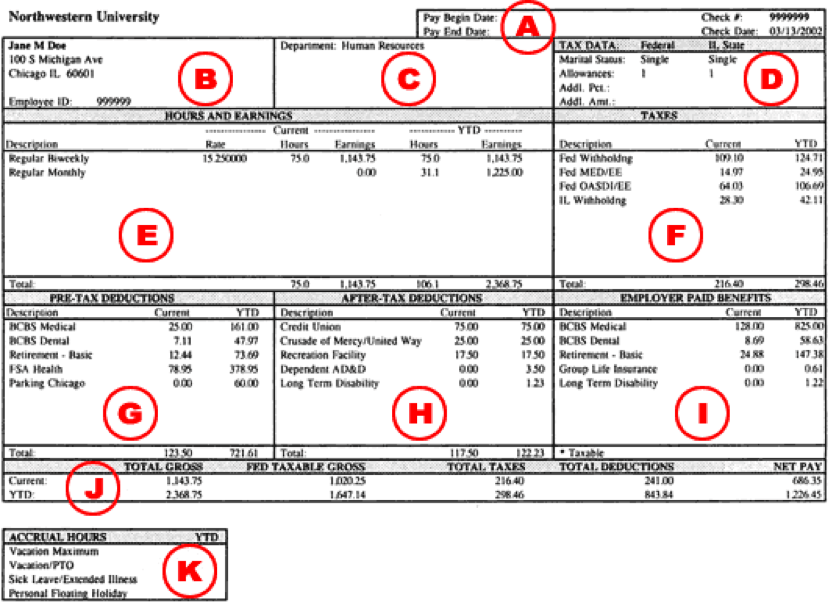

The earnings section details out every type of earning you have received during this pay period and your YTD totals. Calculating paychecks and need some help. With numerous tax filing options you can work in a way that best suits you.

The easiest way to calculate your payroll taxes and estimate your after-tax salary. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. For disposable earnings between 21750 and 290 any amount above 21750 would be garnished.

With more than 45 years of expertise we are one of the premier payroll and HR leaders in the North East. Doing your own taxes. The form assists employers to collect the proper amount of federal income taxes from your wages.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. For weekly earnings of 290 or more a maximum of 25 percent could be garnished. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Gross Pay This is the amount youre paid before any taxes or deductions are taken out. At first seeing taxes taken out of your paycheck can be a little disappointing. The comprehensive way to calculate payroll taxes include.

Which makes the deduction unavailable for donations made directly from your paycheck.

Understanding Your Paycheck Credit Com

Here S How Much Money You Take Home From A 75 000 Salary

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Understanding Your Paycheck Human Resources Northwestern University

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

Check Your Paycheck News Congressman Daniel Webster

Paycheck Taxes Federal State Local Withholding H R Block

Pay Stub Meaning What To Include On An Employee Pay Stub

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How To Read Your Pay Stub Paycheckcity

Understanding Your Paycheck Youtube

Here S How Much Money You Take Home From A 75 000 Salary

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Direct Deposit Advice Jmu